Technical vs Fundamental Analysis : Trading Strategies for Different Timeframes

Technical vs Fundamental Analysis represent two core approaches to trading and investing, each offering a distinct lens for understanding the markets. While both aim to anticipate price movements, they operate differently: Fundamental Analysis evaluates a company’s intrinsic value through financial statements, industry trends, and economic indicators, making it ideal for longer-term investment decisions. Technical Analysis, by contrast, focuses on price action, chart patterns, and market psychology to uncover short- to medium-term trading opportunities. Knowing how and when to apply each method – based on your preferred timeframe – can create a more balanced strategy and improve the likelihood of consistent trading success.

Understanding the Two Trading Philosophy

Fundamental Analysis evaluates a security’s intrinsic value by examining economic, financial, and other qualitative and quantitative factors. This includes analysing financial statements, assessing industry conditions, reviewing economic indicators, and evaluating company management to determine long-term growth potential. Technical Analysis, in contrast, focuses on price movements and trading volumes to identify patterns and forecast future price action. It involves chart pattern recognition, interpreting technical indicators, analysing trading volume, and tracking support and resistance levels. While both methodologies provide valuable insights, they emphasize fundamentally different aspects of market behaviour and are often suited to different types of traders and investment timeframes

Key Differences : Approach and Timeframe

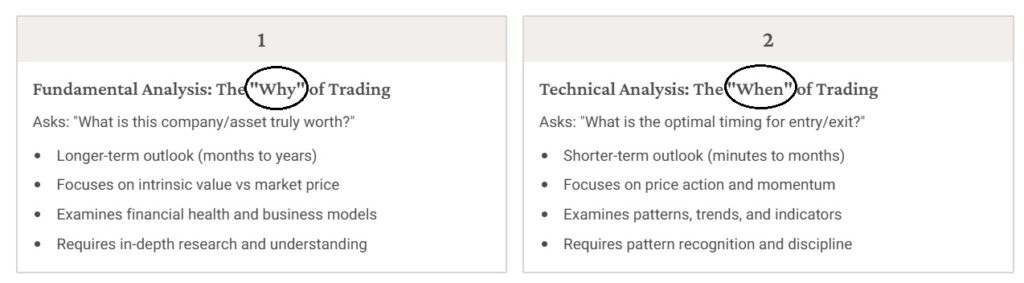

Fundamentalists are primarily concerned with uncovering value, while technicians focus on timing market movements, often independent of an asset’s underlying worth. Fundamental Analysis, the “why” of trading, asks, “What is this company or asset truly worth?” It takes a longer-term perspective—spanning months to years—emphasizes intrinsic value over market price, examines financial health and business models, and demands thorough research and understanding. Technical Analysis, the “when” of trading, asks, “What is the optimal timing for entry or exit?” It typically applies to shorter-term horizons—from minutes to months—focuses on price action and momentum, analyses patterns, trends, and technical indicators, and requires strong pattern recognition skills and disciplined execution.

Most Popular Fundamental Analysis

The most popular tools in fundamental analysis focus on evaluating a company’s intrinsic value through financial, operational, and strategic factors. Investors examine financial statements—including income statements, balance sheets, and cash flow statements—to assess profitability, liquidity, and overall financial health. Valuation ratios like P/E, P/B, and dividend yield help determine whether a stock is fairly priced, while profitability metrics such as ROE, ROA, and operating margins measure efficiency. Analysts also consider industry trends, economic indicators, and corporate governance to understand the broader context in which a company operates. Growth metrics, including revenue and earnings growth, provide insight into a company’s future potential. Together, these tools help investors answer the fundamental question: “What is this company truly worth?”

Not all fundamental analysis metrics carry the same weight for every type of investor. Retail investors often prioritize straightforward, easy-to-understand indicators that help quickly assess a company’s valuation, growth potential, and income prospects. Professional investors, by contrast, typically dig deeper, analysing cash flows, efficiency ratios, management quality, and macroeconomic factors to build a comprehensive view of a company’s intrinsic value and long-term prospects. Understanding which metrics are most relevant for your trading style or investment horizon can help you focus on the data that matters most and make more informed decisions

Retail Investors:

-

Price-to-Earnings (P/E) Ratio – Simple and widely understood measure of valuation.

-

Dividend Yield – Popular among income-focused investors.

-

Revenue and Earnings Growth – Easy indicator of company performance.

-

Debt Levels / Debt-to-Equity Ratio – Basic risk assessment.

-

Industry Trends – General understanding of sector growth potential.

Professional Investors:

-

Cash Flow Analysis – Focus on operating cash flow and free cash flow for sustainability.

-

Return on Equity (ROE) / Return on Assets (ROA) – Key efficiency and profitability metrics.

-

Valuation Ratios (P/E, P/B, P/S) – More nuanced, often used in combination with other data.

-

Management Quality and Governance – Assessed through reports, interviews, and track record.

-

Economic and Macro Indicators – Integrated into forecasts and scenario analysis.

Adoption Among Different Trader Type

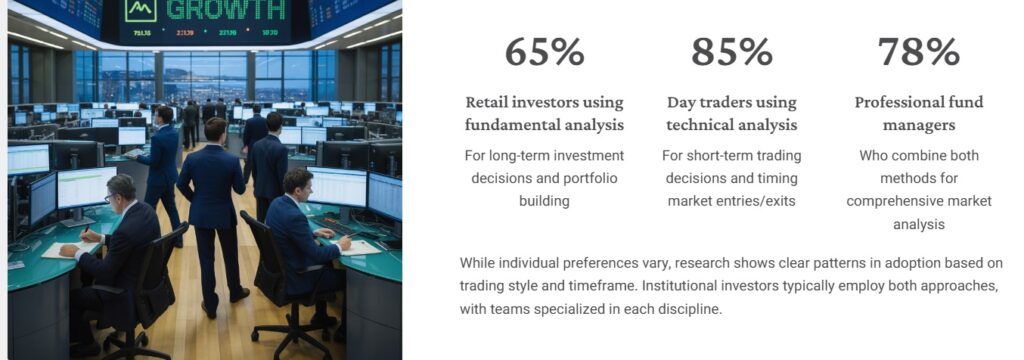

Adoption of fundamental and technical analysis varies widely depending on trading style and timeframe. While individual preferences differ, clear patterns emerge: institutional investors often employ both approaches, leveraging specialized teams for fundamental research and technical modeling to inform strategic decisions. Long-term investors tend to rely more heavily on fundamental analysis, focusing on a company’s intrinsic value and growth potential, whereas short- to medium-term traders often emphasize technical analysis, using price patterns and indicators to time entries and exits. Understanding how different trader types integrate these methodologies can help retail investors adopt strategies that align with their own goals and time horizons

Why Fundamental Analysis Dominates Long Term Trading?

Warren Buffett’s success over decades exemplifies the power of disciplined fundamental analysis in achieving extraordinary long-term results. By focusing on value over noise, fundamental analysis helps investors cut through short-term market volatility to identify truly undervalued assets with strong appreciation potential. It also enables growth potential identification, highlighting companies with robust business models, innovative capabilities, and solid market positions. Furthermore, fundamental analysis supports risk management by providing a deeper understanding of long-term risks, including industry shifts, competitive threats, and financial stability, allowing investors to make informed decisions grounded in both opportunity and prudence.

When Technical Analysis Shine?

Even investors who primarily rely on fundamental analysis, gain significant edge by incorporating technical analysis, improving entry and exit timing and potentially boosting annual returns by several percentage points. Technical analysis becomes especially valuable in specific scenarios: for short-term trading, it provides precise entry and exit points for day and swing traders; in understanding market sentiment, it offers insights into crowd psychology and momentum; for timing decisions, it helps optimize trades based on fundamental evaluations; and in volatile markets, it brings structure through pattern recognition, helping investors navigate rapidly changing conditions. By combining fundamental insights with technical tools, traders can make more informed and strategically timed decisions without abandoning their long-term investment approach.

Real World Use Case: When to Apply Each Approach

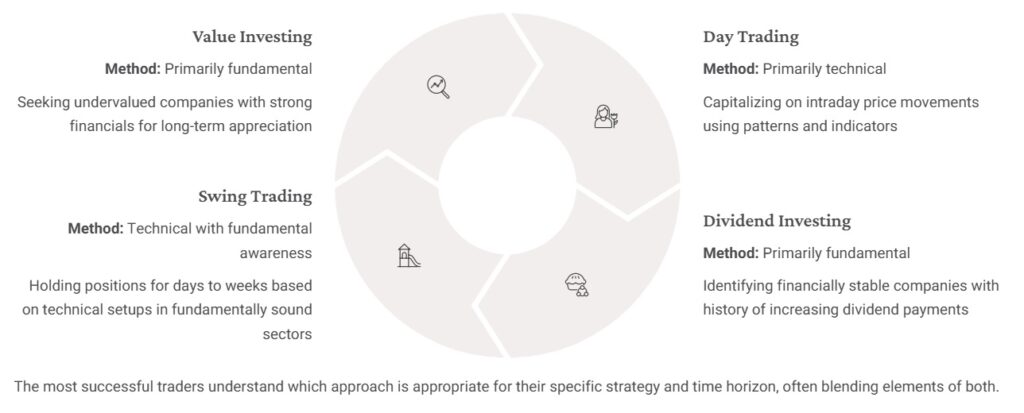

The most successful traders recognise which approach—fundamental, technical, or a blend of both—best suits their strategy and time horizon. Value Investing relies primarily on fundamental analysis, focusing on undervalued companies with strong financials and long-term appreciation potential. Day Trading, in contrast, is primarily technical, aiming to capitalize on intraday price movements through chart patterns, indicators, and market momentum. Dividend Investing also leans on fundamentals, targeting financially stable companies with a consistent history of growing dividend payments. Swing Trading blends technical analysis with fundamental awareness, holding positions for days to weeks based on technical setups in fundamentally sound sectors. By aligning methodology with trading style, investors can enhance decision-making, risk management, and overall performance

Synergy Effect: Combining Both Approach

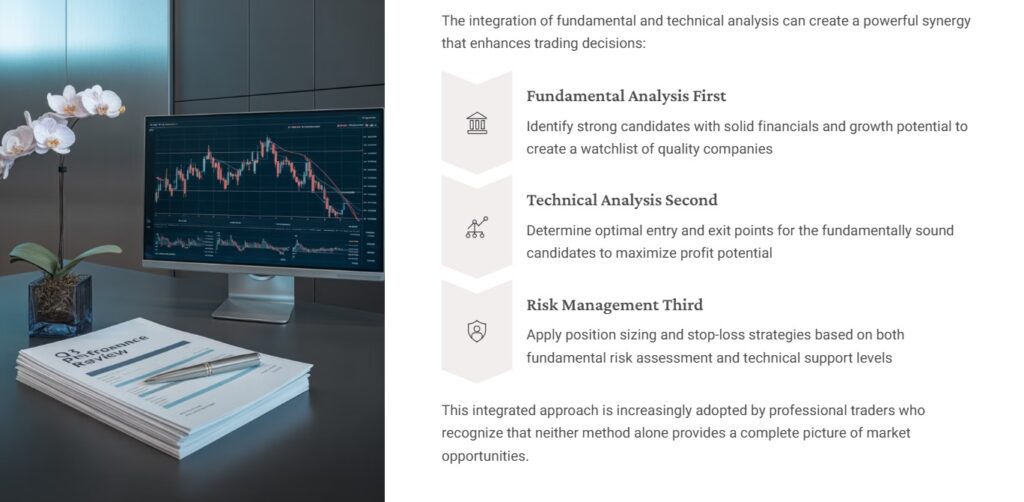

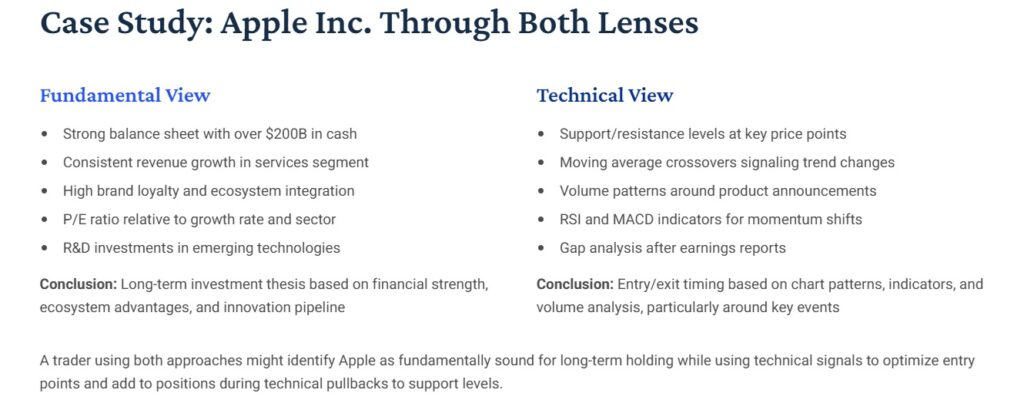

The integration of fundamental and technical analysis can create a powerful synergy that enhances trading decisions. Fundamental analysis comes first, helping traders identify strong candidates with solid financials and growth potential to build a watchlist of quality companies. Technical analysis follows, determining optimal entry and exit points for these fundamentally sound candidates to maximize profit potential. Finally, risk management is applied, using position sizing and stop-loss strategies informed by both fundamental risk assessments and technical support levels. This integrated approach is increasingly adopted by professional traders, who recognize that neither method alone provides a complete view of market opportunities.

Key Takeaways : Building Your Trading Strategies

Markets reward different approaches at different times, and the most resilient traders develop skills in both fundamental and technical analysis, applying each when conditions favour that method. Know your timeframe: longer horizons generally benefit more from fundamental analysis, while shorter-term trades rely heavily on technical approaches. Understand your strengths: some traders excel at fundamental research, while others have strong pattern recognition skills—building on these natural abilities enhances performance. Complement your approach: even if you favour one method, basic literacy in the other can improve overall trading effectiveness. Finally, keep learning: both disciplines continually evolve with new metrics, indicators, and tools, and successful traders commit to ongoing education to stay ahead.

AionStocks takes this integrated approach a step further by combining the strengths of both fundamental and technical analysis within its AI-driven system. The platform begins with fundamental analysis to screen for high-quality stocks based on financial health, growth potential, and intrinsic value. It then applies technical analysis through advanced AI algorithms to rank and filter these candidates, identifying optimal entry and exit points while managing risk. By embedding both methodologies into a single workflow, AionStocks empowers traders to make more informed, data-driven decisions without sacrificing efficiency or control.