Robinhood Automated Trading: Opportunities and Limitations

The rise of platforms like Robinhood has redefined how everyday investors engage with the stock market, making trading more accessible, intuitive, and cost-efficient than ever before. Now, with the emergence of automated trading features, retail traders are beginning to explore tools once reserved for institutions and hedge funds. Automated trading on Robinhood offers the promise of speed, efficiency, and emotion-free execution—but it also raises critical questions about control, reliability, and risk management. Understanding both the opportunities and the limitations of this technology is essential for traders who want to harness its potential without falling into its pitfalls.

In this presentation, we’ll explore how Robinhood’s platform compares to other brokerages for algorithmic trading, examine the pros and cons of automated trading bots, and introduce a powerful alternative approach with EOD analysis from AIonstocks.

The Current State of Automated Trading on Robinhood

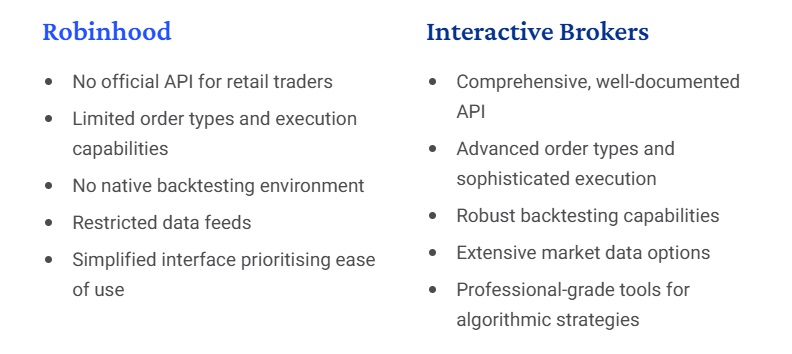

While Robinhood has transformed retail investing with its commission-free model and user-friendly design, its automation capabilities remain limited and fall short of competitors like Interactive Brokers or TD Ameritrade.

Limited API Access

Robinhood’s API is highly restricted compared to platforms like Interactive Brokers, making fully automated trading difficult for retail users.

Third-Party Workarounds

Some third-party services offer automation for Robinhood, but they often require sharing account credentials—introducing significant security and privacy risks.

Unofficial Tools

Developers have created unofficial API wrappers (such as robin_stocks), yet these lack official support and are prone to breaking whenever the platform updates.

Comparing Robinhood to Interactive Broker

Robinhood Trading Automation

Robinhood Trading Automation

Automated trading bots rely heavily on clean, consistent, and predictable data patterns. While bots can process information faster and make trades more efficiently than any human, their performance is only as good as the quality of the assets they trade. So, what makes a stock ‘ideal’ for use with trading bots?

Robinhood Automation vs Interactive Broker Automation

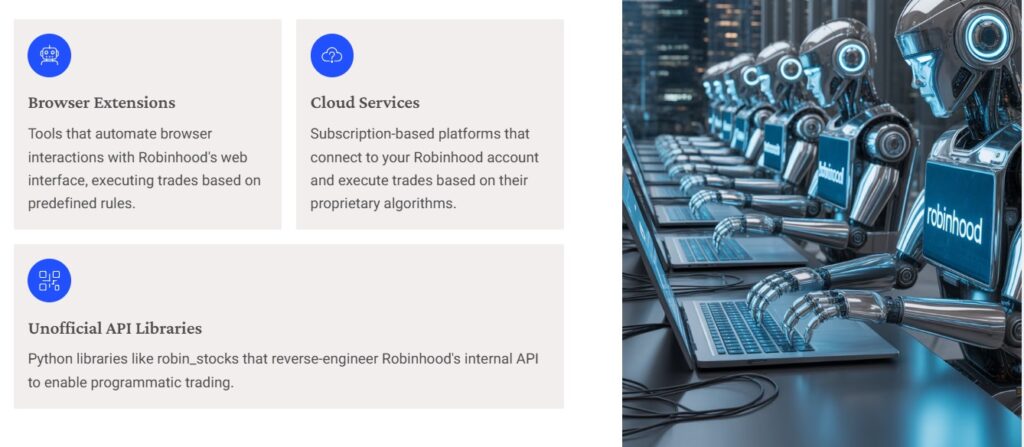

Rise of 3rd Party Trading Bots for Robinhood

Because Robinhood doesn’t offer built-in support for automated trading, a number of third-party solutions have popped up to fill the gap. Some use browser extensions that automate actions on Robinhood’s web platform, placing trades based on preset rules. Others offer cloud-based services, where you subscribe and let their proprietary algorithms trade directly through your account. There are also unofficial API libraries, such as robin_stocks, which reverse-engineer Robinhood’s internal systems to enable programmatic trading—though these come with reliability and security concerns.

Critical Risk of Automated Trading Bots

Before embracing automated trading bots on any platform, traders should carefully weigh several risks that are often downplayed in promotional materials.

Security Vulnerabilities : Most bots require access to your login credentials or API keys, which opens the door to potential theft or unauthorized transactions if the service is compromised.

Performance Issues : Backtested results often look impressive but rarely translate directly to live trading. Factors like slippage, latency, and rapidly changing market conditions can significantly reduce actual performance.

Technical Failures : Bots are not immune to technical issues. Connection errors, platform updates, or software bugs can result in missed trades or even incorrect executions—sometimes with costly consequences.

Black Box Algorithms : Many automated services operate as “black boxes,” offering little to no transparency about how their algorithms work. This lack of visibility makes it difficult to validate their methods or adapt them when market conditions shift.

The Myth of “Set and Forget” Trading

The idea of earning effortless “passive income” through fully automated trading bots is more marketing hype than reality. While the concept is appealing, it oversimplifies the complexity of financial markets and misrepresents what it truly takes to trade successfully.

Experienced traders understand that markets are dynamic ecosystems, constantly shifting in response to news, sentiment, and macroeconomic forces. Even the most sophisticated automated systems cannot be left unattended—they require regular oversight, fine-tuning, and adaptation to changing conditions.

In truth, profitable trading is never a set-and-forget process. It demands continuous learning, market awareness, and refinement of strategy. Automation can streamline execution and improve efficiency, but no algorithm can deliver consistent long-term success without human supervision and thoughtful adjustment.

A better Approach: EOD Analysis before Market Opens

End-of-day (EOD) analysis provides a practical and sustainable trading approach, especially for retail traders balancing full-time jobs or other commitments. By focusing on daily data rather than intraday fluctuations, EOD analysis reduces the pressure of split-second decisions, lowers transaction costs, and allows for more deliberate position sizing and risk management. Daily charts help filter out market noise, highlighting meaningful price movements and increasing the likelihood of higher-probability setups while minimizing false signals. This method also supports a healthier work-life balance, letting traders spend just 30–60 minutes after market close reviewing potential trades and placing orders for the following day, rather than being glued to screens all day.

AIonStocks’ approach to stock analysis focuses on end-of-day data, training AI models on daily closing prices alongside market context to estimate the probability of upward or downward movement for the following session. These EOD signals strip away the noise of intraday swings and help reveal the underlying directional tendencies of stocks—a perfect input for trading bots that execute next-day strategies.

How AIonStocks Identifies the Best Stocks to Use with Trading Bots

AIonStocks doesn’t just throw out random stock picks or hand over full control to automation. Instead, it starts with a user-defined screening process based on fundamental criteria such as EPS, market cap, sector, valuation metrics, and more—tailored to match each trader’s specific strategy or risk appetite. This ensures that the stocks under consideration already meet the user’s baseline requirements for quality and relevance.

Once this shortlist is created, AIonStocks applies its AI-powered models to rank the selected stocks based on next-day trading potential, analyzing patterns in price action, sentiment, technical signals, and historical behavior. The result is a prioritized list of high-probability trade candidates that align with both sound fundamentals and technical momentum.

Importantly, the trader remains in full control. AIonStocks does not auto-execute trades or override your judgment—it simply provides smart, data-backed guidance to help you make more informed decisions. Whether you’re using a trading bot or placing trades manually, AIonStocks helps you focus your strategy on the right stocks, at the right time, without removing you from the driver’s seat.

Consistency Over Surprises

One surprising insight from years of EOD analysis is that the best stocks for trading bots are not always the most popular or most talked-about. Consistency beats hype. Stocks that habitually respond to technical breakouts or mean-reversion signals with repeatable patterns form the backbone of successful algorithmic strategies. AIonStocks’ recommendations are built around this data-driven philosophy rather than mere speculation or market buzz.

Next-Day Potential: A Key Advantage for Bot Traders

When your trading bot is built on credible next-day predictions, you unlock a powerful advantage. Unlike intraday strategies vulnerable to price noise and micro-volatility, next-day strategies can be timed more effectively and require fewer executions—lowering costs and reducing exposure to slippage.

AIonStocks EOD models calculate the statistical direction of stocks with granular probability scores, allowing bots to be programmed with actionable thresholds. For example, a bot could pace its trades based on the strength of a signal—going all-in on 80%+ probability forecasts and reducing exposure when confidence is lower.

Reducing Human Bias with Data

The most successful trading strategies are often the least emotional. By relying on EOD predictions to inform bot activity, traders effectively outsource their decision-making to evidence, not guesswork. This not only reduces bias but also removes impulsive trading mistakes common in manual strategies.

With AIonStocks acting as the logic layer, your trading bot becomes a smarter, more strategic executor—placed to act only when statistical edges are present. Over time, this discipline helps build confident, principled trading behaviour with real-world results.

Choosing the Right Stocks for Your Bot Strategy

There’s no single best list of tickers to plug into a trading bot. However, by combining AIonStocks‘ high-confidence predictions with stocks that feature strong liquidity, tighter spreads, and proven chart patterns, the odds begin swinging in your favour. Think of each trade your bot executes as a data-backed hypothesis. Choosing assets with strong predictive support is like narrowing your scope to only the high-percentage bets.

This is also where AIonStocks users gain the edge. The platform doesn’t just hand you stock names—it offers a ranked list, updated daily, indicating top candidates predicted to move favourably by the next session. Imagine waking up with a ready-made, AI-curated shortlist of stocks that align with your trading rules. That’s the future of automated trading—and it’s happening now.

Final Thoughts: Elevating Trading Bots Through Smarter Stock Selection

Trading bots alone won’t deliver profitable results unless they’re deployed with strategic intelligence. That means feeding them the best stocks suited to their approach—datasets that align with what the bot is trying to exploit. With AIonStocks’ EOD data, traders can access next-day probabilities driven by AI and select assets that show proven, consistent alignment with predictability. The result? More confidence, fewer losing trades, and much smarter automation.

Whether you’re a seasoned quant or a trader looking to dip into algorithmic territory, understanding which are the best stocks to use with trading bots is no longer a guessing game. With guidance from platforms like AIonStocks, using powerful end-of-day forecasts, your trading bot can be more than just fast—it can be right, too.