How Futures Algo Trading is Evolving with Intelligent Signal Filtering

The world of stock trading is in the midst of a dramatic evolution. As we enter a new era of market analysis, artificial intelligence is redefining how traders uncover opportunities, interpret signals, and refine their strategies. This presentation examines how AI-powered stock screening is empowering retail and semi-professional traders to navigate the markets with greater precision and confidence—while maintaining full control over their decisions, rather than handing the reins to fully automated systems.

The Signal to Noise problem in Modern Market

Modern markets present traders with a daunting signal-to-noise problem: an endless stream of news, social media chatter, and technical data that often overwhelms decision-making. Conflicting indicators frequently point in opposite directions, compounding uncertainty, while emotional biases drive impulsive reactions and costly mistakes. This overload of information creates the perfect storm—where profitable opportunities slip by unnoticed, and poor choices arise from misinterpreted or incomplete data. In this environment, intelligent signal filtering emerges as a critical tool for cutting through the noise and enabling clearer, more confident trading decisions.

Information Overload : Today’s traders face 24/7 news cycles, social media noise, and countless technical indicators that can overwhelm decision-making processes.

Conflicting Signals : Different technical indicators often present contradictory signals, leaving traders uncertain about which to trust in volatile market conditions.

Emotional Bias : Human psychology remains one of the greatest obstacles to consistent trading success, leading to impulsive decisions and missed opportunities.

These challenges create a perfect storm where potentially profitable trades are missed while poor decisions are made based on incomplete or misinterpreted data. This is precisely where intelligent signal filtering becomes invaluable.

AI Advantage beyond Traditional Screener

Traditional stock screeners rely on rigid, rule-based filters that struggle to keep pace with evolving market dynamics, ignore unstructured data like news and sentiment, and lack the context to recognize patterns across diverse datasets. Their binary “yes/no” approach often overlooks subtle but meaningful opportunities. In contrast, AI-powered screening goes beyond these limitations—adapting in real time to shifting conditions, integrating multiple data sources, and uncovering nuanced insights that human traders and static tools would miss, giving traders a decisive edge in a complex market.

Limitations of Traditional Screeners:

- Static rules that don’t adapt to changing market conditions

- Inability to process unstructured data (news, sentiment)

- No context awareness or pattern recognition across datasets

- Binary filtering that misses nuanced opportunities

AI-powered screening transcends these limitations by dynamically adapting to market conditions and synthesizing insights across multiple data dimensions that would be impossible for humans to process manually.

Signal Filtering Revolution

The signal filtering revolution is transforming trading by combining AI’s analytical power with human judgment. By integrating data from technical indicators, fundamentals, news, sentiment, and institutional flows, AI systems uncover hidden correlations and predictive patterns that traditional analysis often overlooks. Through intelligent, context-aware filtering, they surface the most relevant opportunities tailored to a trader’s strategy and risk profile—while leaving the final execution firmly in human hands. This creates the optimal balance between manual analysis and full automation, harnessing AI to enhance decision-making without surrendering control.

Real World Performance Matrix

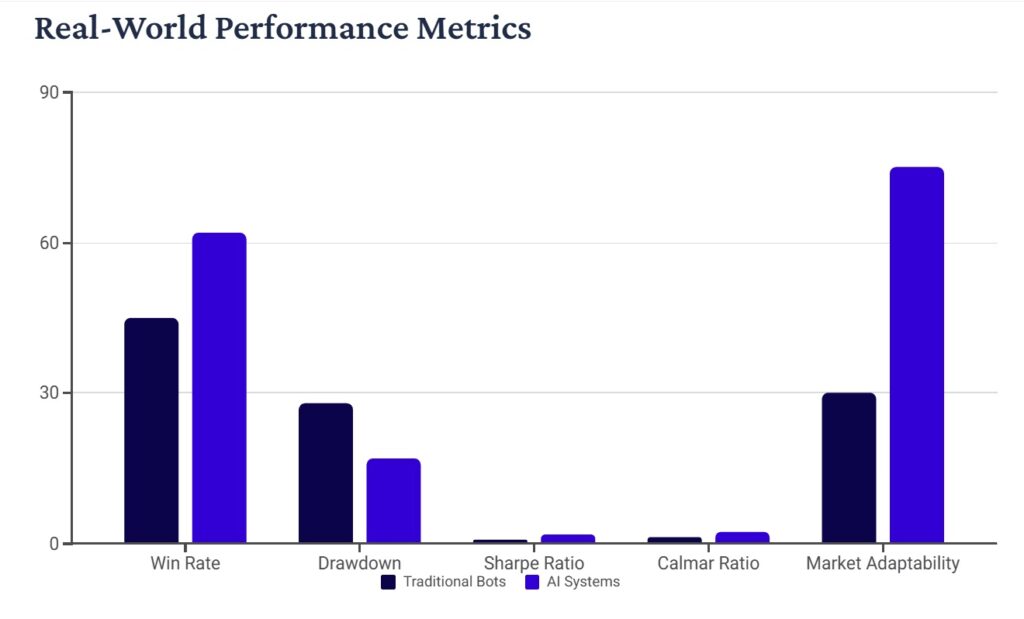

Empirical backtests across major futures markets (S&P 500, Crude Oil, Treasury Bonds, Euro FX) demonstrate AI’s superior performance metrics. Most notably, AI systems show remarkable adaptability during changes, maintaining effectiveness when traditional algo bots experience significant performance degradation.

The Calmar and Sharpe ratio improvements highlight AI’s ability to deliver more consistent returns with better risk-adjusted performance—critical metrics for professional traders and fund managers.

Case Studies: E-mini S&P 500

A comprehensive two-year study of E-mini S&P 500 futures trading reveals striking differences in performance between traditional indicator-based bots and modern AI systems:

- AI systems identified 87% of significant market turning points with an average lead time of 2.3 candles

- Traditional bots captured only 41% of turning points, often with late entries after momentum had already established

- During the March 2020 volatility spike, AI systems reduced false signals by 73% compared to conventional algorithms

- AI entry signals demonstrated significantly improved performance during overnight sessions when liquidity conditions change dramatically

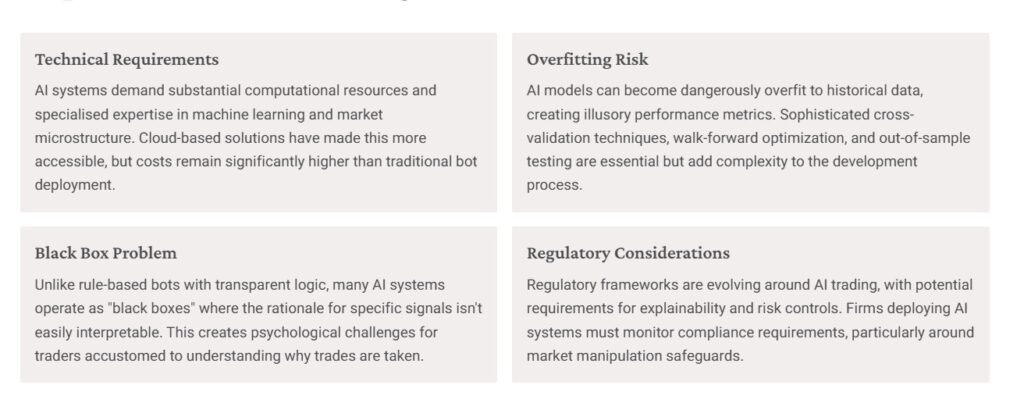

Implementation Challenge and Consideration

Tempting as it may be, full automation—letting a futures trading bot execute your trades start to finish—comes with serious limitations. Volatility is both a threat and an opportunity, but bots are notoriously poor at reacting to unexpected news events or one-time spikes. Once conditions deviate from the backtested script, even a “profitable” bot can spiral into drawdown.

Worse yet, many retail-focused bots lack proper risk management protocols or error handling, often doubling down on failing trades or trading outside allowable margin. These failures aren’t hypothetical—they’re daily realities for many unfortunate bot users who trusted automation over oversight.

This is why the growing segment of traders are moving toward semi-automated systems—ones boosted by AI insights but anchored in human judgment. It’s not about being faster than the market; it’s about being more adaptive to it.

Hybrid Approach: How AIonstocks Signal Filtering Work

Aionstocks AI signal filtering works by aggregating end-of-day data from technical indicators, fundamentals, market sentiment, news, and institutional activity. Its advanced machine learning algorithms detect meaningful correlations, divergences, and historically significant patterns within this EOD dataset, assigning each potential opportunity a confidence score based on the strength and consistency of signals. The system then presents the highest-probability trades with supporting evidence, allowing you to make informed, final decisions. By learning from both market outcomes and your feedback, AION continually refines its filtering precision to align with your unique trading style and preferences.

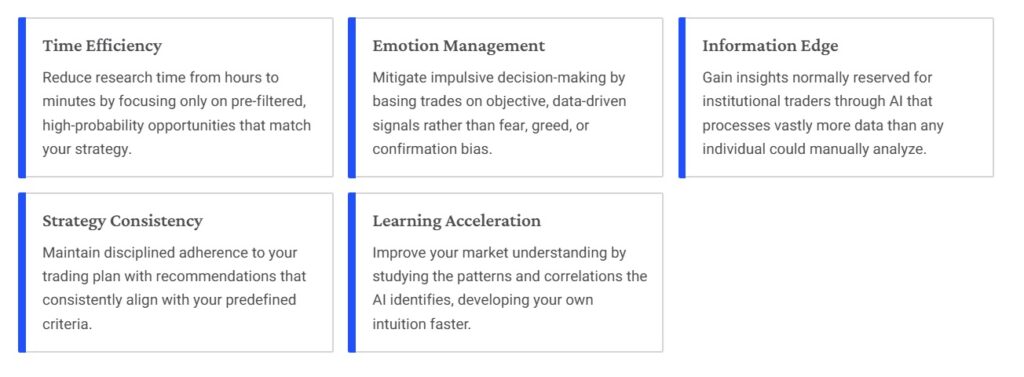

Key Advantage for Retail and Semi-Pro Traders

AIonstocks provides retail and semi-professional traders with a powerful edge by transforming how they approach the markets. It saves time by narrowing focus to high-probability, pre-filtered opportunities, reduces emotional biases by grounding decisions in objective data, and delivers insights typically reserved for institutional traders. By consistently aligning recommendations with your strategy, it reinforces disciplined trading while also accelerating learning, helping you understand market patterns and develop intuition more quickly.

Getting Started with Intelligent Signal Filtering

Getting started with intelligent signal filtering is simple: define your trading strategy and risk parameters, choose an AI screening platform that fits your approach, and begin with a paper trading phase to evaluate its recommendations. Provide feedback to help the system learn your preferences, and gradually incorporate AI-driven signals into your decision-making, creating a smarter, more disciplined trading process.

- Define your trading strategy and risk parameters

- Select an AI screening platform that aligns with your approach

- Start with a paper trading period to evaluate recommendations

- Provide feedback to help the system learn your preferences

- Gradually integrate AI signals into your decision process

Remember: The goal isn’t to outsource your trading decisions, but to enhance them with insights you couldn’t otherwise access. For additional resources and implementation guidance, visit aionstocks for our comprehensive guide to AI integration in futures trading operations.