Designing Robust Algorithmic Trading Strategies with AI Scoring Models

Algorithmic trading strategies have evolved rapidly in recent years, with artificial intelligence playing a pivotal role in enhancing decision-making and performance. At the heart of this transformation lies the integration of AI-powered scoring models, designed to assess, rank and filter trading opportunities with greater precision and insight than ever before. In this article, we’ll explore how these intelligent scoring systems can be the cornerstone of a resilient and adaptive algo trading strategy in today’s fast-paced financial markets.

Understanding the Evolution of Algorithmic Trading Strategies

Historical algorithmic trading strategies primarily relied on static rules, technical indicators and quantitative models that executed trades based on predefined parameters. While these early strategies could effectively automate tasks and improve execution efficiency, they were constrained by rigid logic and a lack of adaptability to evolving market conditions.

As markets became more complex and volatile, these limitations became apparent. Traders and quants began exploring methods of introducing dynamic learning capabilities into their models. This shift marked the beginning of a new era—one where AI and machine learning models not only supplemented algorithmic trading systems but began to inform their core design and reasoning processes.

Challenges in Modern Algorithmic Trading

AI Scoring Model : A framework for robust strategies

AI scoring models provide a structured approach to strategy development by quantifying the probability of successful trades based on multiple inputs and learned patterns.

Unlike binary trading signals, scoring models output a continuous probability distribution that better represents the uncertainty inherent in financial predictions. This probabilistic framework allows for more nuanced position sizing and risk management.

Ensemble Methods for Reducing Overfitting

Research shows ensemble methods can reduce prediction variance by 20-30% compared to single models in financial time series forecasting.

Ensemble methods combine multiple models to improve robustness and reduce overfitting. Key approaches include:

- Bagging: Train models on different data subsets (e.g., Random Forests)

- Boosting: Sequentially train models to correct previous errors (e.g., XGBoost)

- Stacking: Use outputs from multiple models as inputs to a meta-model

- Model Averaging: Simple averaging of predictions from different model architectures

Regime-Aware Trading Strategies

Regime-aware strategies use unsupervised learning methods such as Hidden Markov Models or clustering to detect distinct market regimes defined by factors like volatility, correlation, and trend strength. For each regime, specialised models are trained and optimised to match its unique characteristics, avoiding the compromises of a one-size-fits-all approach. A meta-model then dynamically allocates capital across these regime-specific strategies based on current conditions and regime probability estimates, enabling more adaptive portfolio management. Research shows this approach can reduce drawdowns by up to 40% compared to static strategies, particularly during transitional market phases.

Practical Implementation – Walk Forward Validation

Walk-forward validation is a critical technique for evaluating AI trading models because it mirrors how strategies would perform in real, evolving markets. Instead of relying on a single static train-test split, the historical data is divided into multiple sequential windows, with the model trained on one segment and tested on the immediately following period. This rolling process continues forward through time, ensuring the model is always tested on unseen data that chronologically follows its training phase, just as it would encounter in live trading.

By repeatedly retraining and testing in this incremental manner, walk-forward validation provides a more realistic picture of how the model adapts to shifting market conditions. The key objective is not just to maximise performance in a single window but to evaluate consistency and robustness across diverse environments, including bull, bear, and sideways markets. This helps guard against overfitting, highlights periods of vulnerability, and builds confidence that the strategy can generalise effectively to future, unseen data.

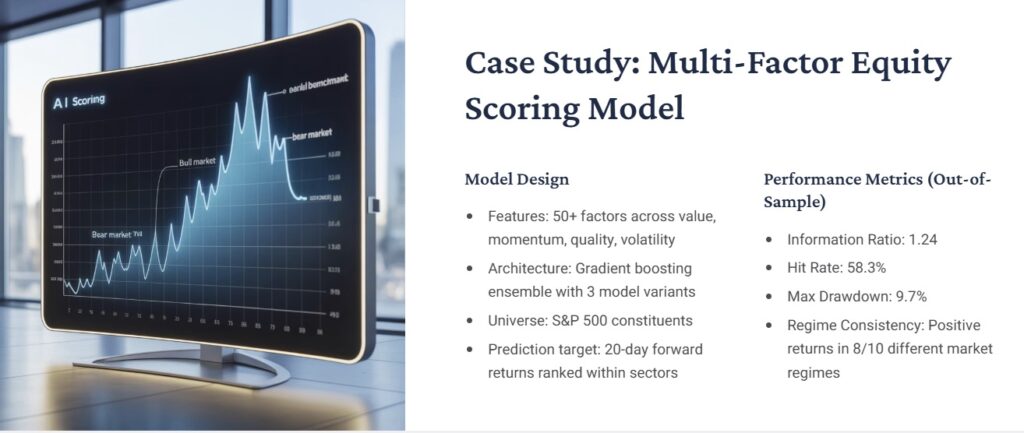

Case Studies

Key Takeaway: Navigating the Future of Automated Trading

A probabilistic framework enhances trading decisions by moving beyond rigid buy/sell signals to probability distributions, allowing for more nuanced execution and better risk management. Ensemble methods further strengthen this approach by combining multiple models, which reduces overfitting and increases resilience across varying market conditions. Together, these techniques create a more flexible foundation for strategy design, enabling systems to respond to uncertainty with greater precision.

Equally important is regime awareness, where strategies dynamically allocate between models tailored to specific market environments, ensuring adaptability through cycles of volatility, correlation shifts, and trend changes. To validate such systems, rigorous methods like walk-forward testing and out-of-sample evaluation are essential to confirm robustness and generalisability. Ultimately, the future of algorithmic trading lies in adaptive, ensemble-based frameworks that can seamlessly adjust to evolving regimes while sustaining consistent, reliable performance.

Start Your Hybrid Trading Journey Today

For additional resources and implementation guidance, visit aionstocks for our comprehensive guide to AI integration in futures trading operations.