Why Smart Traders Are Switching to AI-Based Stock Trading Analysis Apps

According to a 2023 report by J.P. Morgan, AI and data science are now used in over 60% of institutional trading strategies, and the number is growing steadily. Meanwhile, retail traders have begun accessing similar tools through AI-based screeners and stock forecasting software, enabling data-backed decisions once only available to hedge funds.

The Limitation of Traditional Trading Analysis

Traditional trading analysis faces key limitations in today’s data-heavy, fast-paced markets. With millions of data points generated daily, no human can manually process the sheer volume across thousands of stocks—leading to missed opportunities. Emotional decision-making further undermines consistency, as fear, greed, and cognitive biases cloud judgment. Add to this the time constraints of deep analysis, and traders are often forced to sacrifice either depth or market breadth, leaving blind spots that can cost performance.

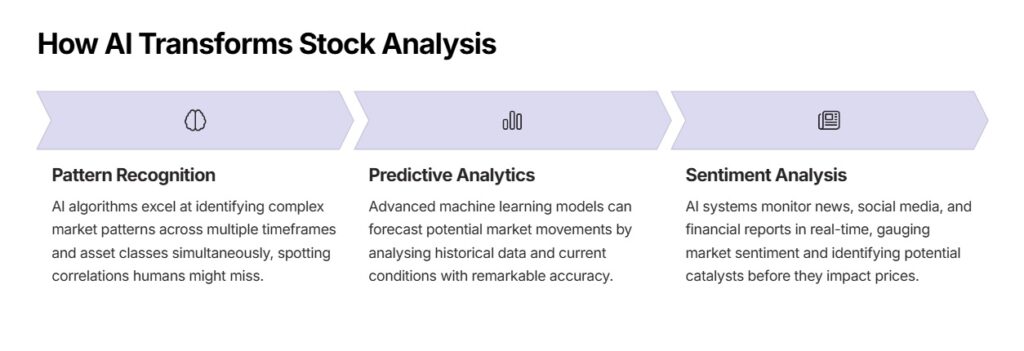

How AI Transform Stock Analysis

AI is transforming stock analysis by delivering speed, scale, and precision that traditional methods simply can’t match. Through advanced pattern recognition, AI algorithms detect intricate trends and correlations across multiple timeframes and asset classes—far beyond human capability. Predictive analytics leverages historical data and real-time inputs to forecast price movements with increasing accuracy, giving traders a proactive edge. Additionally, AI-driven sentiment analysis continuously scans news, earnings reports, and social media to gauge market mood, uncovering early signals and potential catalysts before they move prices. Together, these capabilities enable smarter, faster, and more informed trading decisions.

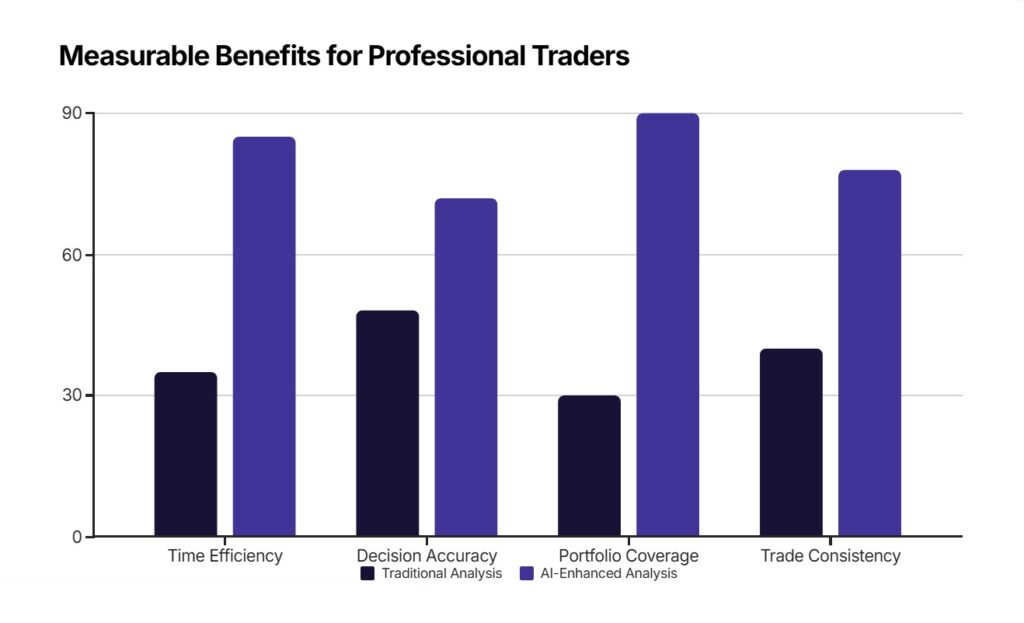

Measurable Benefits for Professional Traders

According to a recent study by the Cambridge Centre for Alternative Finance, traders utilising AI-powered analysis tools experienced a 42% improvement in decision accuracy and were able to monitor three times as many potential opportunities compared to traditional methods alone.

Most importantly, these traders reported significantly higher consistency in their results, with reduced performance volatility and fewer emotional trading errors.

The Benefits Driving the Switch

The popularity of AI stock trading apps isn’t just based on hype — it’s rooted in real-world value. Traders who adopt these solutions often experience improved win ratios, better portfolio management, and enhanced trading confidence. By leveraging artificial intelligence, they’re able to automate routine tasks, test strategies against historical data, and stay informed about market events the moment they happen.

Moreover, the scalability of these apps allows users to handle diversified portfolios, manage risk exposure intelligently, and adapt their strategies to suit different market conditions. Whether it’s swing trading, day trading, or long-term investment monitoring, AI technology can be tailored to fit a wide range of use cases.

From Early Skepticism to Mainstream Adoption

While early iterations of AI in trading were met with skepticism, the technology has matured significantly. Today’s AI stock trading apps are built using advanced deep learning models, natural language processing, and adaptive algorithms that rival even the most sophisticated institutional tools. As real-world results continue to validate the promise of AI, adoption rates among individual traders, hedge funds, and investment firms have surged.

Leading financial platforms are now integrating AI as a core feature, and start-ups specialising in AI-based trading are gaining momentum at an unprecedented rate. This marks a defining moment in financial technology — where AI is no longer optional, but an essential component of strategic trading.

Challenges and Considerations

Despite the clear advantages, traders should be aware that AI stock trading apps are not without their challenges. Understanding how the AI works, verifying the data it’s trained on, and managing expectations are important elements. These tools are incredibly efficient, but not infallible. Human oversight remains critical, particularly when it comes to interpreting nuanced market behaviour or responding to black swan events.

Furthermore, regulatory implications and data privacy concerns are increasingly relevant. Smart traders must use apps that adhere to financial compliance standards and offer transparency in how decisions are made. Choosing the right platform is key to unlocking the full benefits of AI trading while minimising potential risks.

The Future of Trading Is AI-Driven

The integration of AI into trading analysis is not merely a trend but represents a fundamental shift in how markets are analysed and traded. As we look ahead, several key developments are likely to accelerate this transformation:

- Quantum computing will enable even more sophisticated analysis of market data at unprecedented speeds

- Natural language processing will continue to improve, allowing AI to better interpret nuanced information in financial reports and news

- Personalised AI assistants will learn individual trading styles and risk preferences to provide highly tailored recommendations