Interactive Brokers Automated Trading Bots vs. Hybrid AI Trading: Why We Chose a Better Way

Automated trading bots have been gaining popularity among traders, especially with platforms like Interactive Brokers that offer robust APIs for automation. These bots promise 24/7 monitoring of the markets, lightning-fast order execution, and the ability to follow strategies without emotions. But are they really the best way to trade?

At AIonStocks.com, we are not automated trading bots. Instead, we believe in a hybrid approach that combines the power of AI with human judgment. Before we explain our solution, let’s look at the pros and cons of automated trading bots.

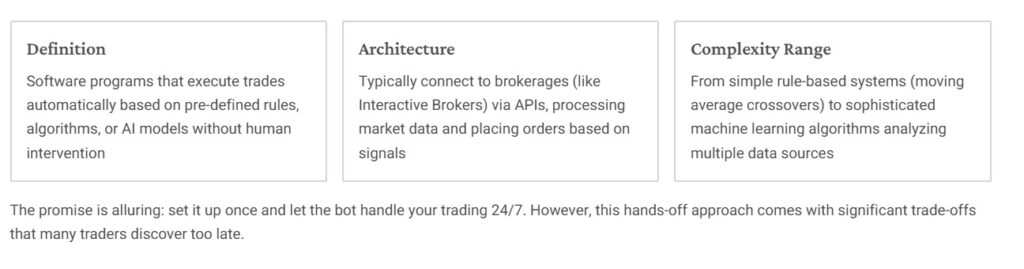

Understanding Automated Trading Bots

Automated trading bots are software programs that connect to brokerage platforms (like Interactive Brokers) to analyse market data, identify opportunities, and place trades automatically based on pre-defined rules or algorithms.

They eliminate manual intervention, making trading faster and often more systematic. Many professional and retail traders use bots for scalping, arbitrage, and trend-following strategies.

The Promise Behind Automated Trading Bots

Automated trading bots offer several advantages for traders. They bring speed and efficiency, reacting to market changes in milliseconds to capture opportunities instantly. Since they operate without emotion, they eliminate the fear, greed, or hesitation that often impact human decisions. Bots can also provide 24/7 monitoring, scanning markets around the clock across global exchanges and after-hours sessions. Finally, they allow for backtesting, enabling traders to test strategies on historical data and refine them before putting real money at risk

The Reality: Critical Challenges with Automated Bots

Despite their advantages, automated trading bots come with serious challenges. They often suffer from over-optimization, performing well on past data but failing in real markets. Unexpected events such as breaking news or black swan scenarios can trigger massive losses, while technical failures like connectivity issues, coding errors, or API glitches may lead to missed or misfired trades. Bots also lack human judgment, making them unable to interpret sentiment, political risks, or sudden market shifts. Finally, there’s the risk of over-reliance, as leaving bots to trade unattended can be dangerous without proper oversight.

A Better Approach: Hybrid Solution

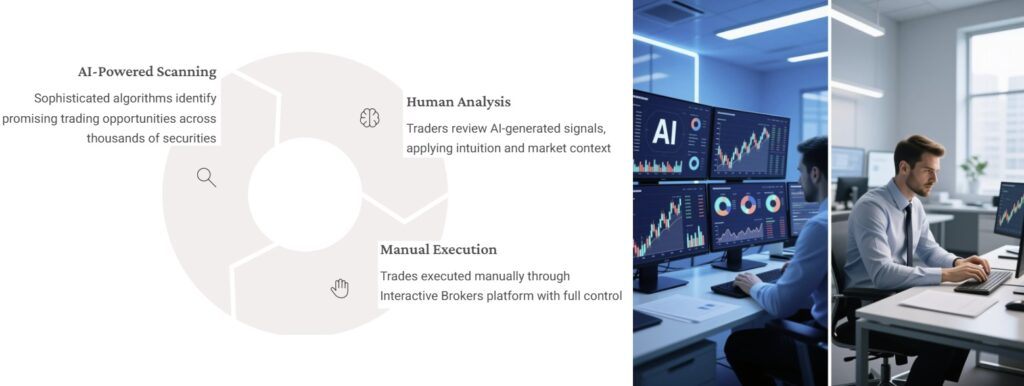

Instead of surrendering complete control to automated bots, what if we could harness AI’s analytical power while keeping the critical execution decisions in human hands? Here’s how it works:

-

AI Scans the Market – Our algorithms process stock data, patterns, and indicators to highlight actionable setups.

-

User Control – Instead of auto-trading, the trader reviews these opportunities and places trades manually in Interactive Brokers.

-

Hybrid Balance – AI does the heavy lifting of research and scanning, while humans bring judgment, risk management, and final execution.

Our hybrid approach offers the best of both worlds by keeping human oversight at the centre—you remain in control and make the final trading decisions. The AI provides efficiency without bot risks, scanning markets quickly and accurately to highlight opportunities while avoiding the dangers of fully automated execution. This method also ensures adaptability, as humans can adjust to changing market conditions far better than bots locked into rigid rules. With reduced technical risk, there’s no dependency on fragile API connections or constantly running code, making the process more reliable. Most importantly, this model creates empowered traders, where AI delivers powerful insights without replacing the human judgment that ultimately drives smarter trading.

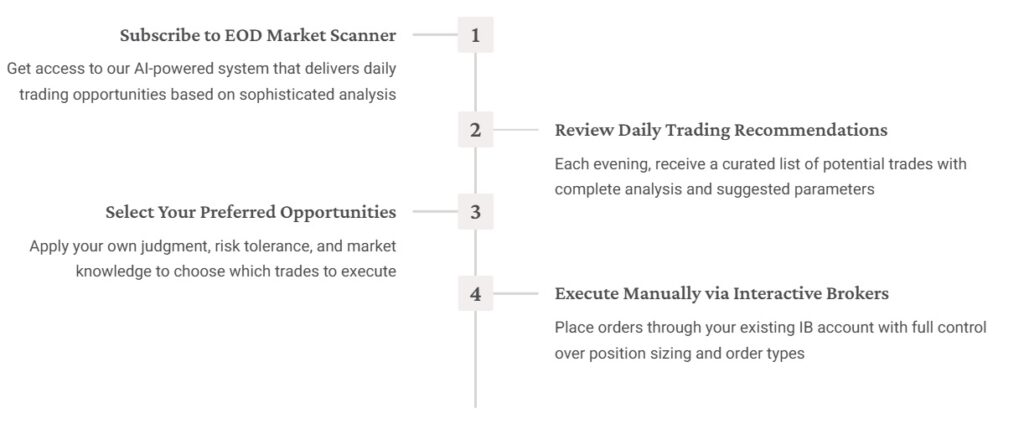

Practical Implementation with Interactive Broker

This process combines the computational power of AI with the flexibility and judgment that only human traders can provide—all while leveraging the robust execution capabilities of Interactive Brokers

Start Your Hybrid Trading Journey Today

Automated trading bots in Interactive Brokers sound appealing, but they come with significant risks. At AIonStocks, we believe the best edge comes from combining AI intelligence with human decision-making.

Our EOD Market Scanner gives you AI-powered insights while keeping you in the driver’s seat. This way, you benefit from speed, accuracy, and data-driven opportunities—without surrendering control to a bot.

👉 Explore how our hybrid AI approach can transform your trading strategy at AIonstocks