How to Find High Growth Stocks – Why the Biggest Stock Market Winners Are Small and Mid-Cap Stocks

When most people think about stock market winners, they imagine household names like Apple, Amazon, or Microsoft. These large-cap stocks dominate headlines, carry vast valuations, and significantly contribute to overall market growth. Yet, a deeper dive into raw performance data reveals a counterintuitive truth—over the past few years, the highest percentage-gaining stocks are rarely these giants. Instead, they’re often small and mid-cap stocks that fly under the radar. For investors wondering how to find high growth stocks, it’s critical to understand why these smaller equities often lead the pack in term of gains.

The Overlooked Winner – Small and Mid Cap

Between 2022 and 2025, financial data has shown a consistent pattern: the highest percentage-gaining stocks are overwhelmingly from the small and micro-cap segments of the market. These shares may not drive the largest total gains in market value, but in terms of percentage returns, they outshine the giants.

For example, Propanc Biopharma experienced a staggering surge of 757,400%, and Regencell Bioscience climbed 10,323%. Even DeFi Development Corp managed a 2,206% increase. These explosive moves aren’t coincidental—they’re reflective of the kind of growth potential that inherently lies in smaller, less-followed companies. ABIVAX and Zepp Health, both in the mid-cap category with market caps under £6 billion, also delivered massive returns over a short period.

While these names might not dominate news cycles or feature heavily in popular investment indexes, their agility, niche markets, and sometimes undervalued status offer fertile ground for extraordinary short-term gains.

The Large-Cap Paradox: Big Companies, Modest Growth

On the other end of the spectrum, large-cap stocks—especially the “Mag Seven” (Apple, Amazon, Meta, Alphabet, Microsoft, Nvidia, and Tesla)—have undoubtedly delivered immense value over the past decade. From 2014 to 2024, these seven giants added about $15.8 trillion in market cap, comprising roughly 40% of the overall market gain during that time.

In 2024 alone, the largest 1% of stocks in the market accounted for 74% of total US market cap growth, with the top 10% contributing a remarkable 94%. These corporations, thanks to their size and global scale, have the power to move entire indexes. But here’s the catch: they rarely rank among the top performers by percentage growth in any given year.

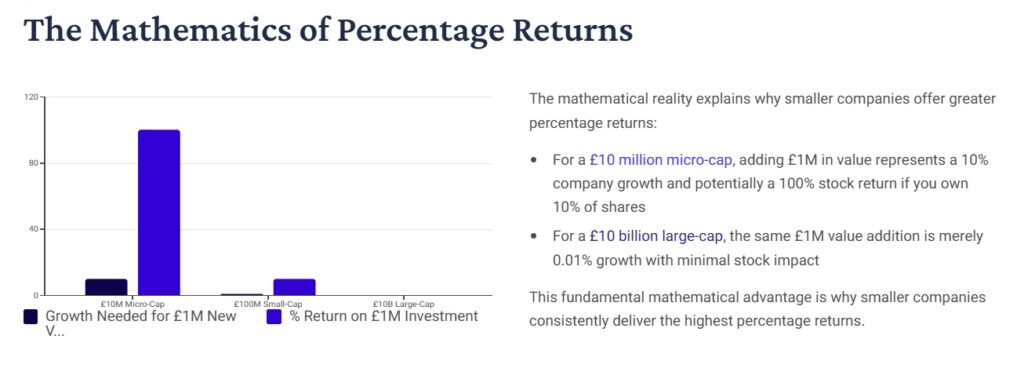

Why? Because their starting valuations are so immense that achieving even double-digit percentage growth requires astronomical increases in real-dollar value. A 10% gain on a trillion-pound company requires a far bigger leap than a 1,000% gain on a micro-cap firm worth £10 million.

Small Cap vs Large Cap : Growth Advantage

Small- and mid-cap companies often present unique advantages for investors. Because they are not yet at full maturity, they typically have far more room for exponential growth compared to their large-cap peers. Many of these businesses receive less attention from Wall Street analysts, which can create opportunities for mispricing and undervaluation in the market. Additionally, smaller firms often have the potential to significantly boost their revenues through just one or two major contracts—something that would barely register in the financials of a large corporation. Their nimble structures also allow for quicker decision-making and more adaptability, enabling them to respond swiftly to market shifts or new opportunities.

Large-Cap Limitations

By contrast, large-cap companies, while stable and established, come with certain limitations. Because they already dominate their respective markets, their capacity for outsized growth is more constrained. Moving the needle on earnings often requires massive revenue increases, which can be difficult to achieve at their scale. These companies are also heavily scrutinized by analysts, leaving fewer opportunities for hidden value. On top of that, large corporations often face stricter regulatory oversight, which can limit their ability to make bold or unconventional strategic moves.

Why Small Cap deliver Outsized Returns

Small Cap operate in areas of the market where inefficiencies are more common. With less analyst coverage and lower visibility, their valuations can be mispriced, creating opportunities for investors to uncover hidden value. Beyond this, small caps typically have a much longer growth runway, as they are still in the early stages of scaling their businesses and expanding into new markets. On top of that, many of these companies are attractive acquisition targets for larger firms seeking to accelerate growth or enter new segments, which can provide additional upside for shareholders.

How to Find High Growth Stocks: Look Smaller

When evaluating small-cap opportunities, investors should focus on companies with innovative business models that disrupt traditional industries or create entirely new market categories with large addressable markets. It’s equally important to analyse the revenue growth trajectory, prioritizing businesses that consistently deliver 20%+ annual growth while showing improving margins, a clear sign of scalability. The quality of management is another critical factor, with founder-led teams who hold meaningful ownership stakes and have proven success in scaling businesses often driving stronger long-term outcomes. Finally, monitoring institutional ownership trends can provide valuable insight, as rising investment from large funds often signals expanding research coverage and can precede significant price appreciation.

If your goal as an investor is to uncover high return potential rather than stable contributions to portfolio weighting, the small and mid-cap arena is where most of the action lies. While they carry more volatility and inherently higher risk, they also retain a level of upward mobility that is no longer available to the mega-caps due to the law of large numbers

Understand Market Capitalisation Dynamics

Small-cap and micro-cap stocks represent a tiny fraction of the total market’s value. However, they demonstrate consistent appearances on the leaderboard of annual percentage gainers. They thrive in niches, early adoption cycles, or dislocation periods where mainstream investors have not yet caught on.

In contrast, large-cap stocks, while dominant in underlying value creation, rarely deliver triple-digit growth. Their size becomes a double-edged sword—acting as both a protective moat and a growth ceiling.

Revisiting the Small Cap Premium

Historically, finance theories supported the “small cap premium”—the idea that smaller stocks provide higher long-term returns. However, over the past 20 years, this relationship has reversed. Large caps have outperformed small caps on average, largely due to the tech-driven rise of dominant mega-cap companies.

Yet, despite this trend, the biggest individual winners by percentage remain small and mid-cap stocks. This suggests that while overall small caps might underperform as a group, individual breakout plays continue to reside at the lower tiers of market value. For those researching how to find high growth stocks, ignoring this layer of the market is a missed opportunity.

Volatility vs Opportunity

Of course, it would be irresponsible to highlight the massive gains in small cap stocks without also mentioning the elevated risks. Micro-cap companies are often plagued by low liquidity, limited access to capital, and lack of financial transparency. Many investors get burned chasing performance without conducting proper due diligence.

However, discerning investors equipped with patience, a clear investment thesis, and a willingness to sift through the lesser-known names can position themselves to capture exceptional gains that are statistically improbable among the big-name stocks. It’s not just about chasing wild returns—it’s about strategically understanding where those returns statistically emerge.

Final Thoughts: The Asymmetry of Returns

Large-cap stocks will always dominate the conversation in mainstream finance—not just because of their brand power but because of the sheer size of the returns they offer in absolute terms. But from a pure percentage performance standpoint, these household names rarely lead the charts.

If you’re genuinely looking at how to find high growth stocks, start by adjusting your lens. Instead of only tracking the S&P 500 or FTSE 100, begin looking further down the market cap spectrum. Delve into small and mid-cap companies with innovative products, proven revenue growth, or disruptive models. The data shows that while giant companies build the foundation of your portfolio, the biggest winners often start small.

In the end, investing doesn’t have to be a binary choice between massive but slow-growing companies and volatile speculative bets. It’s about balance, research, and knowing where the growth hides—often in the very places most people aren’t looking.

To uncover hidden gems and stay ahead in the market, visit us at AionStocks and explore our powerful stock screener. It’s designed to help you identify potential trading opportunities with ease and confidence.